Guaranteed Investment Fund (GIF)

Are you considering investing in a Guaranteed Investment Fund (GIF)? Access to a reliable source of income is essential for your financial security and long-term goals. It can be difficult to decide where and how to invest, however. However, have come across GIFs as an option.

This blog post will explain the basics of buying into this type of fund, its benefits compared to other investments, its downsides, and more. Read on to determine whether a GIF might be the right choice for you – or if another approach might work better.

What is a GIF, and how does it work

A Guaranteed Investment Fund (GIF) is a type of investment fund that offers investors protection against any losses and the potential for higher returns than traditional fixed-income investments.

GIFs are typically offered by insurers or banks, who guarantee that the capital invested will be returned with a minimum rate of return over the investment term.

GIFs can be structured differently, but the most common structure offers investors a guaranteed return of principal at maturity. This means that if the market value of the GIF decreases, investors will still receive their original investment capital back at the end of the term.

Investors can benefit from Guaranteed Investment Funds in several ways. Firstly, they provide investors with a known return at maturity, which helps to mitigate investment risk.

Secondly, Guaranteed Investment Funds offer investors a higher return than traditional fixed-income investments, allowing them to make more from their money.

Finally, Guaranteed Investment Funds are typically offered with various terms and maturities, providing flexibility for investors with different investment goals.

The benefits of using a GIF

A Guaranteed Investment Fund (GIF) offers several distinct benefits for investors looking to grow their wealth over the long term. These include:

Guaranteed principal protection: your investment is guaranteed to be returned at maturity, no matter what market conditions arise during the fund term.

This provides peace of mind for investors concerned about the volatility of the markets.

Guaranteed returns: GIFs guarantee a minimum return on your investment, allowing you to benefit from potential gains in the market without any risk to your principal.

Ability to diversify your portfolio: By investing in a GIF, you can spread your risk across various asset classes and investments, which can help to reduce overall volatility in your portfolio.

Professional management: A GIF is managed by a professional fund manager, who is responsible for selecting investments that meet the fund's stated objectives and risk profile. This helps ensure that your money is managed according to your investment goals.

Overall, Guaranteed Investment Funds offer investors a unique opportunity to benefit from potential market gains without sacrificing any protection for their principal.

How to choose the right GIF for your needs

Choosing the right Guaranteed Investment Fund (GIF) can be challenging. With so many different types of funds available, it can take time to determine which one best meets your needs and goals. To help you make an informed decision, here are a few tips for choosing the right GIF:

1. Consider your investment goals: Before choosing a GIF, consider what you want to accomplish with your investment. Do you want to maximize your return on investment? Are you more interested in preserving capital? How long do you plan to hold the fund? Take time to consider these questions before selecting a GIF.

2. Research different funds: Once you have identified your investment goals, research. Look for funds with a strong track record of performance and those managed by experienced professionals. Compare each fund's fees, returns, and risk profiles to find one that best meets your needs.

3. Consider liquidity: Guaranteed Investment Funds (GIFs) tend to be fairly illiquid, meaning you may need access to your money immediately. Before investing in a GIF, ensure you’re comfortable with the liquidity terms and understand the potential implications of withdrawing your funds early.

4. Review the prospectus: Guaranteed Investment Funds (GIFs) must provide a prospectus that outlines the fund’s investments and objectives. Review the prospectus carefully to ensure you understand what you are investing in and the risks associated with the fund.

The different types of GIFs available

Guaranteed Investment Funds (GIFs) come in a variety of types. Generally, they are classified according to their risk profile and investment strategy. The most common types of GIFs are:

Fixed-income GIFs: These funds invest primarily in fixed-income securities such as bonds and other debt instruments. They aim to provide stability and income while minimizing risk.

Equity-income GIFs: These funds invest primarily in stocks to generate capital appreciation and provide an income stream. They tend to be more volatile than fixed-income GIFs but carry a higher potential for reward.

Balanced GIFs: As the name implies, these funds invest in fixed-income and equity securities. The goal of balanced GIFs is to provide a balance of safety, income, and growth potential.

By understanding the different types of Guaranteed Investment Funds (GIFs) available, investors can make more informed decisions about which type is right for their needs. Knowing which type of GIF is right for you can give you greater peace of mind and clarify your overall financial plan.

How to invest in a GIF

A Guaranteed Investment Fund (GIF) is a type of mutual fund designed to provide investors with increased safety, security, and predictability when investing. It offers an easy way for investors to access the stock market while protecting their capital from potential losses.

When investing in a GIF, it is important to research the fund to ensure it is appropriate for your investment goals and risk appetite. Investors should look into the details of the fund, such as its past performance, management team, fees, and types of investments held in the portfolio.

Once you have chosen a GIF that meets your requirements, you can usually purchase units in the fund through a financial adviser, bank, or directly from the fund manager.

The risks associated with investing in a GIF

When it comes to investing in a Guaranteed Investment Fund (GIF), there are risks involved. On the one hand, this type of investment offers some degree of security due to its fixed-rate nature and low-risk level.

On the other hand, returns may be limited since they are usually lower than other investments. Also, if interest rates in the market fluctuate, returns on GIF investments may decrease.

Additionally, Guaranteed Investment Funds are subject to inflation risk. If inflation rises faster than the interest rate earned from the fund, it could cause a reduction in purchasing power of your initial investment.

Finally, Guaranteed Investment Funds have liquidity risks since they are not typically traded or exchanged daily and may require a large transaction fee.

Despite these risks, Guaranteed Investment Funds are still appealing to many investors because of the low level of risk involved and their potential for steady returns.

Before investing in any type of fund, it is important to understand all its associated risks. This will help ensure your investment strategy is properly tailored to meet your needs and goals.

FAQs

What is a guaranteed investment fund?

A Guaranteed Investment Fund (GIF) is a type of mutual fund designed to provide investors with increased safety, security, and predictability when investing. It offers an easy way for investors to access the stock market while protecting their capital from potential losses.

What are the types of guaranteed investment funds?

The three main types of Guaranteed Investment Funds (GIFs) are equity-income GIFs, balanced GIFs, and money market funds. Equity-income GIFs invest primarily in stocks to generate capital appreciation and provide an income stream.

Are Guaranteed Investment Funds safe?

Guaranteed Investment Funds are generally considered low-risk investments, but there is still the possibility of loss due to fluctuations in market conditions or liquidity risk. Researching any fund before investing is important to ensure that it is appropriate for your investment goals and risk appetite.

Conclusion

To conclude, if you're considering using a loan to purchase an investment property, consider all the options, research your loan choices, and weigh the pros and cons. A loan might be right for you, especially if you are buying a rental property that can generate income.

Finally, considering different borrowing features when selecting an appropriate loan option will help you find the best financing deal that meets your needs, giving you financial security with long-term rewards.

On this page

What is a GIF, and how does it work The benefits of using a GIF How to choose the right GIF for your needs The different types of GIFs available How to invest in a GIF The risks associated with investing in a GIF FAQs What is a guaranteed investment fund? What are the types of guaranteed investment funds? Are Guaranteed Investment Funds safe? Conclusion

By Kelly Walker : Aug 11, 2023

Investment Considerations and Strategies Following a Debt Ceiling Resolution

Observing the financial markets recently would reveal a fascinating dynamic. Explore the best investments for debt ceiling deals in the U.S. in this article.

Read More

14022

By Kelly Walker : Jun 28, 2023

Best Students Credit Cards Of 2023: A Detailed Guide

Get the most out of your college experience by choosing the best student credit cards. We compare and review the top picks so you can make an informed decision.

Read More

9332

By Kelly Walker : Mar 06, 2023

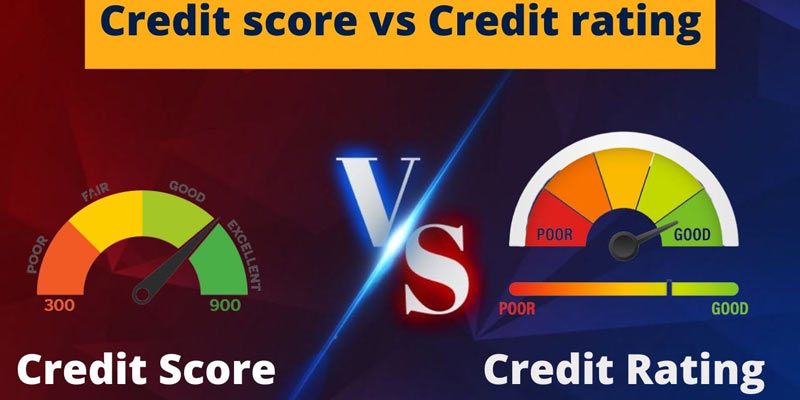

Credit Rating vs. Credit Score: What’s the Difference?

Wondering what the difference is between your credit rating and credit score? This post breaks it all down for you, so you can understand how they work together to impact your finances.

Read More

13547

By Rick Novak : May 01, 2023

How FIFA Makes Money

Learn how the world's leading football organization makes money and why it’s still successful. Get an in-depth look at their business strategies to generate revenue and drive success.

Read More

16277

By Verna Wesley : Sep 05, 2024

A Beginner’s Guide to Commingled Funds: Key Concepts and Advantages

What a commingled fund is, how it works, and the different types of commingled funds available. Learn about the benefits and considerations in this comprehensive guide

Read More

17037

By Rick Novak : Mar 29, 2023

Top Agriculture Stocks 2023

The top agriculture stocks for investors to consider focus on companies with a strong market position, innovative products, and a commitment to sustainability. The ten companies highlighted in the article include Archer-Daniels-Midland Company, Deere and Company, Nutrien Ltd., Bunge Limited, Corteva, Inc., Agrium Inc., Monsanto Company, Syngenta AG, Mosaic Company, and Zoetis Inc. Investing in these companies can provide exposure to the agriculture sector and the potential for long-term growth.

Read More

14093

By Kelly Walker : Jan 28, 2023

Should You Buy a House at Auction?

Purchasing a home through an auction can be a great way to secure a property at a good price. However, there are risks associated with the process that must be taken into account. Before bidding on a property, it is important to research and ensures all paperwork is in order.

Read More

11035

By Kelly Walker : Mar 30, 2023

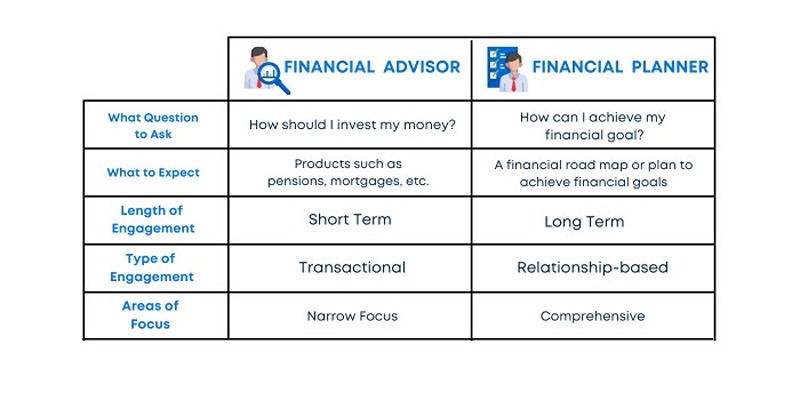

Financial Planner vs. Financial Advisor: What’s the Difference?

Have you ever wondered about the difference between a financial planner and a financial advisor? Find out here! Learn which type of professional to turn to for help so that you can make informed decisions about your finances.

Read More

11521

By Rick Novak : Mar 07, 2023

Guaranteed Investment Fund (GIF)

Are you looking for a safe and reliable investment option? A Guaranteed Investment Fund, or GIF, may be the perfect choice for you.

Read More

14364

By Kelly Walker : Apr 21, 2023

How Bankruptcy Affects Your Ability to Secure Credit

Are you facing financial difficulties? Learn how declaring bankruptcy can and cannot affect your ability to secure credit in the future. Get expert advice on how to make sure you remain financially secure while going through this process.

Read More

12389

By Kelly Walker : Mar 29, 2023

Advantages And Rewards Of Using A Victoria's Secret Credit Card

Victoria's Secret Credit Card offers various advantages and rewards, including exclusive access to sales and events, free shipping on select purchases, bonus points for every dollar spent, birthday gifts, and early access to new product launches.

Read More

13956

By Kelly Walker : Mar 30, 2023

How to Read the Letter Offering You Financial Aid

A student's financial aid eligibility and the amount of aid they will receive are outlined in an award letter. The document details the terms and conditions of several financial aid forms, such as grants, loans, work-study, and scholarships. Making educated decisions about paying for college and avoiding unexpected fees or debt requires a thorough understanding of the information provided in the award letter.

Read More

1802