How to Read the Letter Offering You Financial Aid

Applying for financial aid is an essential part of the college application process. Governments at all levels, as well as institutions and nonprofits, can and do offer financial aid to students. After submitting your financial assistance application, you will receive an award letter detailing the various aid packages you have been approved for. To make the best decision about how to pay for college, you need to comprehend your financial aid award letter fully. This article is for you if you need help deciphering your financial aid award letter.

What Is A Letter Of Financial Aid Award?

An award letter for financial aid is a document that details the various forms and quantities of assistance to which you have been awarded. After you submit your FAFSA, the institution or university you intend to attend will send you an acceptance letter (FAFSA). The Free Application for Federal Student Aid (FAFSA) is a form used to apply for federal student aid, such as grants, loans, and work-study programs. You could receive funding from multiple sources, including the federal government, your home state, your chosen university, and even private scholarship organizations.

Parts Of A Letter Offering Financial Aid

Usually, a financial assistance award letter will be broken down into multiple sections. A financial assistance award letter often includes the following information:

Attendance Fees (COA)

The COA is the total amount you can expect to pay for one year of college or university. The COA and the cost of attending college often cover expenses like transportation, books, and food. The Cost of Attendance (COA) is an important section of the financial aid award letter because it estimates how much money you will need to attend the institution or university.

Expected Family Contribution (EFC)

The EFC is the yearly amount your family expects to put toward your college expenses. Your family's income, assets, and the number of college-bound members all determine your Expected Family Contribution (EFC). Your eligibility for need-based financial aid will be calculated using the EFC.

Grants

Unlike other forms of financial aid, you don't have to pay back grants. The federal government can provide gifts, a state government, or a college or institution, and are usually given out to those who demonstrate financial need. You are eligible to receive the license (s), and the total amount will be detailed in the financial assistance award letter.

Scholarships

In contrast to other forms of student financial aid, scholarships do not require repayment. Usually, academic performance or demonstrated expertise in a particular sector decides who receives a scholarship. Colleges and universities, in addition to private groups, may also provide financial aid through scholarships. The scholarship(s) you are qualified to earn, and the total amount will be detailed in the financial assistance award letter.

Understanding The Terms Of Your Financial Aid Award Letter

To make educated decisions about how to pay for college, you must fully grasp the provisions of your financial aid award letter. Some important definitions:

Need-based help

You may qualify for need-based aid if your family has a demonstrated financial need, as calculated by the Expected Family Contribution (EFC). Grants, work-study, and federally-subsidized loans are all forms of financial help awarded based on financial need. Your eligibility for and the amount of need-based aid you get are also factors.

Merit-based aid

The term "merit-based aid" refers to financial assistance granted to a student based on their accomplishments in school or some other area of interest. Scholarships and various types of grant help are awarded based on merit. The amount of your merit-based award is determined by your academic performance and the quantity of money that is available.

Subsidized loans

Subsidized loans are a type of federal loan in which the government agrees to cover the interest payments while the borrower is a full-time student. While enrolled at least half-time and at certain other times, such as the six-month grace period following graduation, the federal government will cover your interest payments on your student loan.

Unsubsidized loans

Interest will accrue on federal loans while you are a student if you take out an unsubsidized loan. Like with any loan, you must keep up with interest payments while enrolled and beyond. Capitalization occurs when interest is added to the principal sum of a loan.

Direct PLUS loans

Graduate/professional students and parents of undergraduate dependents are eligible for Direct PLUS loans, which are federal loans for higher education costs. Credit checks are done on applicants for PLUS loans, and the interest rate could be higher than on other federal loans.

Conclusion

Knowing how to decipher your financial aid award letter is essential to make educated decisions about how to pay for college. The letter details your eligibility for various forms of financial help, the exact amount you will receive, and any other relevant terms and restrictions. Making educated decisions about financing your education and preventing unexpected expenses or debt requires an awareness of the components and times of your financial assistance award letter.

On this page

What Is A Letter Of Financial Aid Award? Parts Of A Letter Offering Financial Aid Attendance Fees (COA) Expected Family Contribution (EFC) Grants Scholarships Understanding The Terms Of Your Financial Aid Award Letter Need-based help Merit-based aid Subsidized loans Unsubsidized loans Direct PLUS loans Conclusion

By Rick Novak : Feb 04, 2023

Tax Preparer vs. Software: How You Should Choose

You should use caution in selecting the preparer since you will be liable under the law regardless of who prepares your tax return

Read More

15638

By Kelly Walker : Jun 03, 2023

T. Rowe Price Review

Learn how T. Rowe Price can help improve your financial future with its portfolio management and investing services. Our expert review will provide valuable insight into navigating the world of investments and securing a better retirement plan for yourself!

Read More

18866

By Kelly Walker : Mar 29, 2023

Advantages And Rewards Of Using A Victoria's Secret Credit Card

Victoria's Secret Credit Card offers various advantages and rewards, including exclusive access to sales and events, free shipping on select purchases, bonus points for every dollar spent, birthday gifts, and early access to new product launches.

Read More

12623

By Kelly Walker : Mar 29, 2023

Review Of The Hilton Honors American Express Card 2023

The Hilton Honors American Express Card is a co-branded credit card that allows cardholders to earn rewards and benefits for their stays at Hilton hotels. In this article, we will cover the various benefits and features of the card, the Hilton Honors Rewards program, how to use the card to maximize rewards, and how it compares to other hotel and travel rewards credit cards.

Read More

310

By Rick Novak : May 29, 2023

Best Sales Training Programs

Looking for a sales training program to expand your business knowledge? Get informed and discover the best programs to meet your needs.

Read More

2991

By Kelly Walker : Mar 26, 2023

What Are Best Endeavors?

Do you have big dreams and goals but need to know how to get started? Read our article to learn about the best endeavors, their meaning, and the benefits they bring so you can start progressing toward your success story.

Read More

18877

By Kelly Walker : Apr 21, 2023

How Bankruptcy Affects Your Ability to Secure Credit

Are you facing financial difficulties? Learn how declaring bankruptcy can and cannot affect your ability to secure credit in the future. Get expert advice on how to make sure you remain financially secure while going through this process.

Read More

711

By Kelly Walker : Jul 28, 2023

How To Use Your Roth IRA as an Emergency Fund

Struggling to make ends meet during unexpected financial burdens? Learn how to use your Roth IRA as an emergency fund and secure your future.

Read More

13058

By Kelly Walker : Mar 06, 2023

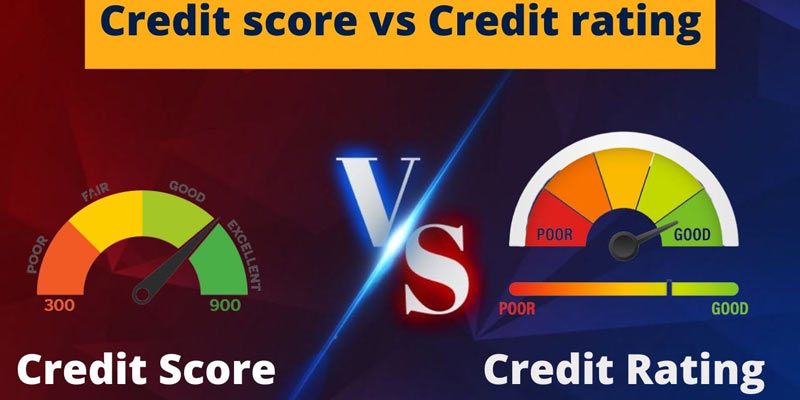

Credit Rating vs. Credit Score: What’s the Difference?

Wondering what the difference is between your credit rating and credit score? This post breaks it all down for you, so you can understand how they work together to impact your finances.

Read More

17141

By Kelly Walker : Jun 02, 2023

What Is a Virtual Credit Card Number?

Get the definitive guide on virtual credit card numbers and explore why it may be the right choice for your business or personal finances. Find out how these secure payment methods work, what they can offer you, and how you can make the most of them.

Read More

8124

By Rick Novak : Feb 04, 2023

Short Tax Year: How To Save Money In The Short Term?

A fiscal year that concludes before December 31 is considered a short tax year. Taxpayers may save money in the long run if the tax year is shortened, even though they may have to pay more taxes at certain points.

Read More

221

By Rick Novak : Mar 30, 2023

Best Ways to Learn Technical Analysis

Improve your market analysis skills and stay ahead with these proven strategies for mastering technical analysis. Quickly learn to identify key trends and make better decisions in any market.

Read More

12748