Investment Considerations and Strategies Following a Debt Ceiling Resolution

Despite the looming debt ceiling crisis, professional investors be relatively unfazed. The lack of interest and student loans debt ceiling deal is explained by the 6.5% increase in the S&P 500 over the past three months, which is an indicator of the 500 largest publicly traded corporations in the United States by market value. The banking crisis in spring was the last time this indicator dropped significantly.

There is an interesting pattern that can be noticed within the markets. By the 26th of May, a diverse array of market sectors and stock sectors began to exhibit an upward trajectory. This was essentially due to the heightened optimism surrounding a potential resolution to the debt ceiling crisis. A large number of sub-industries, comprising nearly three-fourths of the total, showed increased figures for student loans debt ceiling deal on this day.

The sectors leading this upswing included broad-line retail, copper, autos, semiconductors, and electronic manufacturing services. On the contrary, the sectors that lagged behind were other specialty retail, food retail and healthcare distributors.

Investing Amidst the Resolving Debt Ceiling Crisis

As the complexities of the debt ceiling crisis start unwinding and the prospect of a resolution becomes more tangible, it is anticipated that investors will begin to overhaul their strategies and rearrange their investment bets. One crucial date when these ripples began to surface was May 26, when false information of a potential agreement began to spread, instigating speculation around the stocks expected to perform the strongest in debt-ceiling deal.

The Role of S&P Sub-Industry 1500 Indexes

When investigating these stocks, an illuminating source of information to consider is the S&P 1500 sub-industry indexes. These represent the U.S. equity markets by including a diverse range of market sectors and sub-industries. They provide a view of the market and can serve as a helpful tool for spotting potential investment opportunities.

The Rise of High-Return Stocks on May 26

A noteworthy event that unfolded on the actual day, 26TH of May, was the conspicuous rise of several stocks. These stocks distinguished themselves by not only posting high returns but also being rated highly by CFRA, a global leader in financial market research. CFRA's rating system is considered a credible barometer of a stock's potential performance, and a high rating from CFRA often signals a highly effective buy recommendation in debt-ceiling deal.

Five-Star Stocks: A Strong Buy Recommendation

Among these high-return stocks, three were honored with the topmost rating of five stars from CFRA. These elite stocks included Silicon type Labs (SLAB), a provider of silicon, software, and solutions for a smarter and more connected world; Tesla (TSLA), the leading electric vehicle and clean energy company; and McMoRan the freeport (FCX), a premier global mining company. A five-star rating signifies a robust buy recommendation, suggesting that these stocks could offer promising returns.

Four-Star Stocks: A Buy Recommendation

Several other high-return stocks were bestowed with a four-star stock buy recommendation from CFRA. This slightly lower rating, while still indicative of strong potential, suggests slightly more caution is advised compared to five-star stocks. The stocks that received this rating included, again, SLAB, reflecting its strong standing in the market; Energy Enphase (ENPH), a global energy technology company; Equinix (EQIX), the world’s largest data center and collocation provider; Amazon (AMZN), the e-commerce titan; and Sanmina (SANM), a leading integrated manufacturing solutions provider.

Telecommunications

Telecommunications is a second topic industry that could see a potential surge in government spending and, thus, benefit from it. One of the key players that have caught attention in this context is the Vanguard Services of Communication ETF (VOX), with a hefty worth of $2.9 billion, making it the world’s largest and most spread out telecom ETF. The VOX ETF has a low expense ratio of 0.10%, which undoubtedly resonates well with investors. It should be highlighted that VOX’s yield of dividend is a rather modest 0.88%. However, its total returns this year through May 22 was a staggering 24.10%, in comparison to the 9.94% of the 500 S&P.

Sector Of Defense

The defense sector is yet another beneficiary of the proposed debt ceiling deal pass. The deal is expected to increase defense spending for the next year, making it again later in 2025. This surge in spending is anticipated to boost contracts and some orders for defense contractors. Among the 7 defense and the aerospace ETFs, the Invesco Defense and Aerospace (PPA), with a total value of $1.8 billion, yielded the highest return over the last twelve months gap ended on the May of 26, with a return of 11.30 percent. However, the fund’s return YTD falls short of yearly gain of 1.49. The SPDR S&P Aerospace & Defense (XAR) ETF has returned 11.68% so far this year of the EFT of iShares (SHLD).

Stocks Of Infrastructure

The infrastructure stocks present an avenue for investment opportunities in relation to the debt ceiling deal pass. If the government plans to surge investment in infrastructure, including the building, engineering, materials, and transportation industries. This is significant considering that the American Society of Civil Engineers had estimated a budget of $2.6 trillion in 2021 for the repair and maintenance of investment in U.S. transportation infrastructure over the next decade, over and above current plans for funding.

The iShares U.S. Infrastructure Exchange Traded Fund (IFRA) is one approach to profit from this demand. Exactly $1.8B has one of the lowest expense ratios among United States construction financing. Morningstar Direct reports that IFRA has a dividend yield of 1.95 percent, which is higher than the market average.

So, the best investment for debt ceiling deals is probably the ones mentioned above. Despite the rising rates, it’s worth checking these options and investing wisely!

By Kelly Walker : Mar 06, 2023

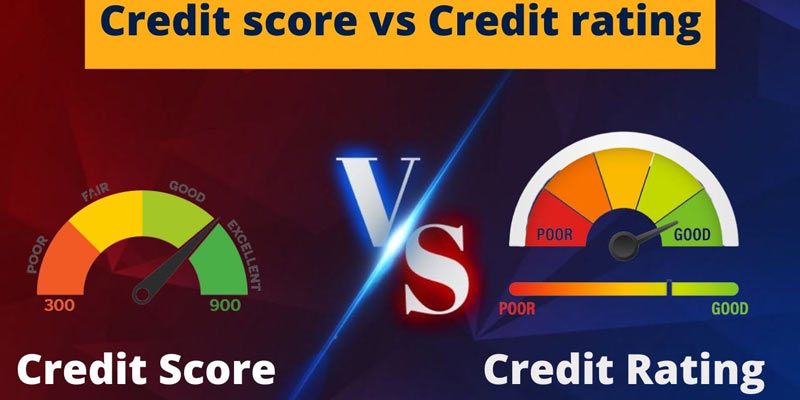

Credit Rating vs. Credit Score: What’s the Difference?

Wondering what the difference is between your credit rating and credit score? This post breaks it all down for you, so you can understand how they work together to impact your finances.

Read More

17934

By Rick Novak : Jan 28, 2023

What Is a No-Load Fund?

No-load funds are an excellent option for investors looking to diversify their portfolios without paying hefty trading commissions. They offer low costs, a wide range of potential returns and the ability to manage risk and maximize returns through proper research and selection.

Read More

16629

By Rick Novak : Jun 28, 2023

M1 Finance Review: An Overview

For experienced investors who favor a low-cost customized portfolio solution, M1 Finance is a wonderful choice. The main customization method is screening and choosing from 60 pre-built investment portfolios or developing your own. The borrowing and spending options offered by M1 Finance may appeal to investors looking for more product possibilities in a platform.

Read More

3991

By Kelly Walker : Jul 30, 2023

Are We in a Bull Market or a Bear Market?

Tired of wondering why stocks and markets fluctuate so much? In this blog post, we’ll explain what separates bear from bull markets and how you can determine which type of market you're currently participating in.

Read More

1965

By Kelly Walker : Mar 30, 2023

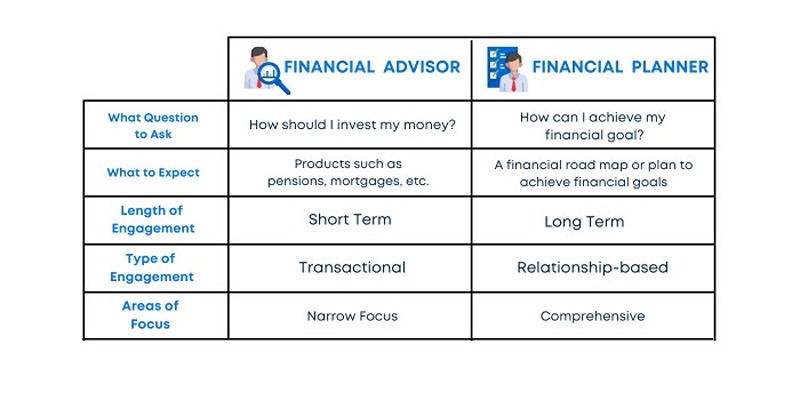

Financial Planner vs. Financial Advisor: What’s the Difference?

Have you ever wondered about the difference between a financial planner and a financial advisor? Find out here! Learn which type of professional to turn to for help so that you can make informed decisions about your finances.

Read More

19640

By Rick Novak : Feb 04, 2023

Short Tax Year: How To Save Money In The Short Term?

A fiscal year that concludes before December 31 is considered a short tax year. Taxpayers may save money in the long run if the tax year is shortened, even though they may have to pay more taxes at certain points.

Read More

9311

By Rick Novak : Mar 30, 2023

Best Ways to Learn Technical Analysis

Improve your market analysis skills and stay ahead with these proven strategies for mastering technical analysis. Quickly learn to identify key trends and make better decisions in any market.

Read More

941

By Rick Novak : May 29, 2023

Best Sales Training Programs

Looking for a sales training program to expand your business knowledge? Get informed and discover the best programs to meet your needs.

Read More

3918

By Rick Novak : Mar 29, 2023

Top Agriculture Stocks 2023

The top agriculture stocks for investors to consider focus on companies with a strong market position, innovative products, and a commitment to sustainability. The ten companies highlighted in the article include Archer-Daniels-Midland Company, Deere and Company, Nutrien Ltd., Bunge Limited, Corteva, Inc., Agrium Inc., Monsanto Company, Syngenta AG, Mosaic Company, and Zoetis Inc. Investing in these companies can provide exposure to the agriculture sector and the potential for long-term growth.

Read More

13641

By Rick Novak : Feb 23, 2023

What is a Prudent Investment

A prudent investment is the acknowledged use of financial securities appropriate for the objectives and goals of the investor. Good fiduciaries closely track the results of the investments they have chosen for their customers to ensure that they are accomplishing their intended goals. The Prudent Investor Rule requires fiduciaries to make sensible investment and financing decisions for their customers based on the data available.

Read More

1311

By Kelly Walker : Jun 03, 2023

T. Rowe Price vs. Vanguard

Choosing a financial company to manage your investments can be intimidating, but this blog post will help you compare the pros and cons of T. Rowe Price vs Vanguard to make the best decision for your investment goals.

Read More

10270

By Kelly Walker : Mar 29, 2023

Review Of The Hilton Honors American Express Card 2023

The Hilton Honors American Express Card is a co-branded credit card that allows cardholders to earn rewards and benefits for their stays at Hilton hotels. In this article, we will cover the various benefits and features of the card, the Hilton Honors Rewards program, how to use the card to maximize rewards, and how it compares to other hotel and travel rewards credit cards.

Read More

12520