Picking the Best Bank for You: A Practical Approach to Making the Right Choice

Choosing the right bank is a crucial decision that directly impacts your financial well-being. Whether youre opening your first account or considering a switch, the options available can be overwhelming. In 2024, banks offer a wide range of services, digital tools, and fee structures that can either enhance or hinder your banking experience.

The key to selecting the best bank for your needs lies in understanding your financial habits, goals, and preferences. This article will walk you through the important factors to consider, helping you make an informed choice that aligns with your lifestyle and financial objectives.

Understanding Your Banking Needs

Before diving into the features and services offered by different banks, its essential to reflect on your personal financial needs. Are you primarily looking for a bank that offers low fees, high-interest savings accounts, or robust digital banking tools? If youre a small business owner, your priorities will differ from someone focused on personal savings. Understanding whether you prioritize accessibility, convenience, or specialized services will guide you toward the right banking partner.

Choosing the Right Bank: What to Consider for Your Banking Needs in 2024

When choosing a bank in 2024, consider these key factors to find the best fit for your needs:

Evaluating Bank fees

Bank fees can quickly add up if you're not careful, which is why understanding the fee structure of potential banks is critical. Common fees include monthly maintenance fees, ATM fees, overdraft charges, and transaction fees. Some banks offer fee waivers if you meet certain conditions, such as maintaining a minimum balance or setting up direct deposits. In recent years, many digital banks have eliminated fees, offering a more straightforward and budget-friendly banking experience.

When comparing fees, its also worth considering how easily you can avoid them. Traditional banks might charge more, but they often provide a broader range of services and in-person support. Online banks, while cost-effective, might not have the branch access or customer service options that suit everyone.

Interest Rates and Account Options

Interest rates are a critical factor, especially if you're focused on saving or investing. High-yield savings accounts can significantly boost your savings, making them ideal for those who prioritize growth overspending. On the other hand, some checking accounts offer minimal interest but come with valuable perks like cashback rewards or free financial planning tools.

In 2024, competition among banks has driven some institutions to offer specialized accounts tailored to specific needs, such as student accounts with no fees or senior accounts with enhanced customer support. Explore the variety of accounts offered, including checking, savings, money market, and certificates of deposit (CDs), to find the ones that align with your financial goals.

Digital Banking and Technology

The shift toward digital banking continues to accelerate, making it crucial to evaluate a banks technological capabilities. A user-friendly mobile app, seamless online banking, and advanced security features are now standard expectations. In 2024, many banks have introduced features like AI-powered financial planning tools, real-time alerts, and budgeting apps that help users manage their money more efficiently.

When choosing a bank, consider how well its digital tools align with your needs. Do you need a highly-rated mobile app for managing daily transactions, or are you more interested in automated savings tools? Some people prefer having access to both a physical branch and digital banking, while others are entirely comfortable with a fully online bank.

Customer Service and Support

No matter how good a banks features are, poor customer service can lead to frustration and lost time. Researching a banks reputation for customer support is essential, especially if you value personalized assistance. Traditional banks usually offer multiple support channels, including phone, email, and in-branch assistance. In contrast, online banks typically rely on chatbots, live chat, and phone support.

Customer reviews and satisfaction ratings are good indicators of a banks service quality. In 2024, many banks have also integrated AI into their customer service, improving response times and accuracy.

Accessibility and Convenience

Accessibility goes beyond digital tools and customer serviceit also includes branch locations, ATM networks, and hours of operation. For those who still prefer in-person banking, the location and availability of branches can be crucial. Traditional banks with extensive branch networks can be more convenient for tasks like cash deposits, check processing, and personalized consultations.

If you rely on ATM access, consider banks that partner with larger ATM networks and offer free withdrawals across multiple locations. Some banks even reimburse out-of-network ATM fees, which can be a significant benefit if you often use ATMs outside of your bank's network.

Account Perks and Rewards

In 2024, banks are offering more perks than ever to attract and retain customers. From cashback on debit card purchases to travel rewards and discounts on financial products, account perks can enhance the overall value you get from your bank. For example, some banks offer free credit monitoring, identity theft protection, or access to investment tools as part of their account packages.

While these perks can be appealing, its important to weigh them against the overall cost of maintaining the account. Dont be swayed by flashy offers if they come with high fees or conditions that are difficult to meet. Instead, focus on perks that genuinely align with your financial habits and goals.

Security and Fraud Protection

With increasing concerns about digital fraud and identity theft, your bank's security measures are more important than ever. Ensure that your chosen bank employs industry-standard security practices, such as multi-factor authentication, biometric logins, and real-time transaction alerts. In 2024, many banks will also offer advanced security features like AI-driven fraud detection and proactive account monitoring.

Its also worth exploring whether the bank has robust recovery processes in place should you fall victim to fraud. Look for guarantees or policies that clearly outline how quickly you can expect to recover lost funds or resolve fraudulent charges.

Conclusion

Choosing the best bank for your needs in 2024 involves careful consideration of your financial habits, goals, and preferences. By understanding what you value mostwhether its low fees, high-tech digital tools, customer service, or interest ratesyou can find a bank that fits seamlessly into your life.

The decision isnt just about comparing rates or features but selecting a banking partner that aligns with your long-term financial strategy. Take the time to research and compare your options, and youll be better positioned to make a choice that supports your financial well-being in the years to come.

On this page

Understanding Your Banking Needs Choosing the Right Bank: What to Consider for Your Banking Needs in 2024 Evaluating Bank fees Interest Rates and Account Options Digital Banking and Technology Customer Service and Support Accessibility and Convenience Account Perks and Rewards Security and Fraud Protection Conclusion

By Kelly Walker : Mar 30, 2023

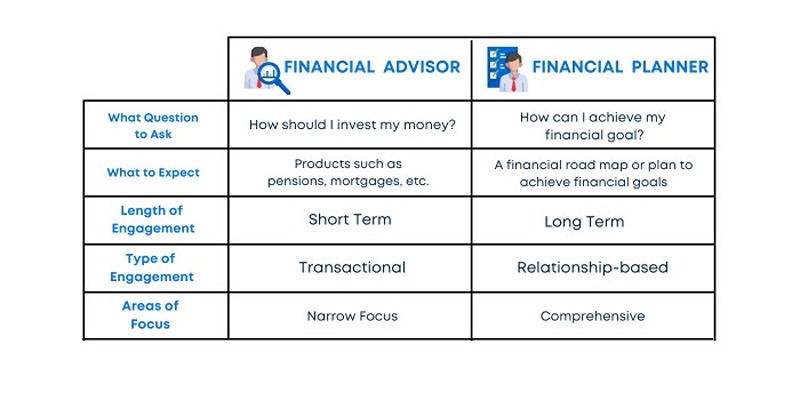

Financial Planner vs. Financial Advisor: What’s the Difference?

Have you ever wondered about the difference between a financial planner and a financial advisor? Find out here! Learn which type of professional to turn to for help so that you can make informed decisions about your finances.

Read More

16877

By Aldrich Acheson : Sep 05, 2024

Picking the Best Bank for You: A Practical Approach to Making the Right Choice

How to choose the best bank for your needs in 2024 by evaluating key factors like fees, customer service, digital tools, and more. Make informed banking choices

Read More

13320

By Kelly Walker : Jul 30, 2023

Are We in a Bull Market or a Bear Market?

Tired of wondering why stocks and markets fluctuate so much? In this blog post, we’ll explain what separates bear from bull markets and how you can determine which type of market you're currently participating in.

Read More

1058

By Kelly Walker : Apr 19, 2023

How to Check Points on your Driving License?

This article will discuss the basics of driver's license points and what you need to know to avoid accumulating points on your driving license.

Read More

9150

By Kelly Walker : Jun 02, 2023

What Is a Virtual Credit Card Number?

Get the definitive guide on virtual credit card numbers and explore why it may be the right choice for your business or personal finances. Find out how these secure payment methods work, what they can offer you, and how you can make the most of them.

Read More

17473

By Kelly Walker : Mar 06, 2023

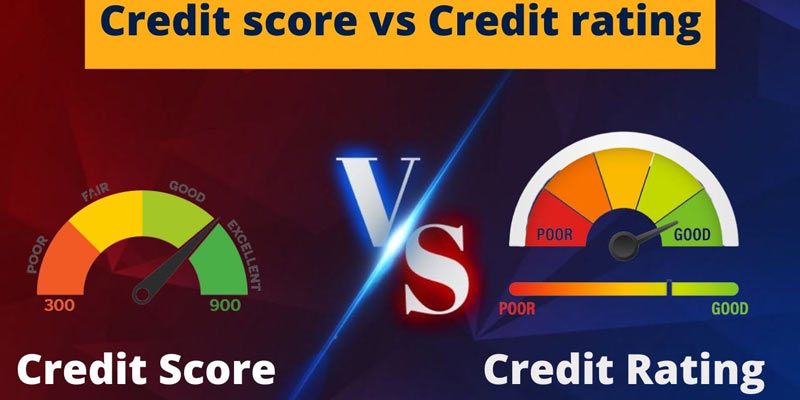

Credit Rating vs. Credit Score: What’s the Difference?

Wondering what the difference is between your credit rating and credit score? This post breaks it all down for you, so you can understand how they work together to impact your finances.

Read More

9240

By Rick Novak : Apr 26, 2023

How Are Fees for ETFs Deducted?

Due to their cheap fees, diversification, and convenience of trading, exchange-traded funds (ETFs) have gained popularity among investors. Many shareholders, however, wonder how ETF fees are removed from their investments.

Read More

5989

By Rick Novak : Mar 07, 2023

Guaranteed Investment Fund (GIF)

Are you looking for a safe and reliable investment option? A Guaranteed Investment Fund, or GIF, may be the perfect choice for you.

Read More

7504

By Rick Novak : Feb 22, 2023

Stocks then and now

Today, investing in the stock market and having an online brokerage account or a retirement plan is not uncommon. However, markets were less liquid, and stock trading was less accessible in the past. In this article, we take a quick look at the stock market conditions from the 1950s to the 1970s from an investors' perspective.

Read More

12929

By Rick Novak : May 01, 2023

How FIFA Makes Money

Learn how the world's leading football organization makes money and why it’s still successful. Get an in-depth look at their business strategies to generate revenue and drive success.

Read More

18549

By Rick Novak : Feb 04, 2023

Tax Preparer vs. Software: How You Should Choose

You should use caution in selecting the preparer since you will be liable under the law regardless of who prepares your tax return

Read More

11555

By Kelly Walker : Jun 03, 2023

T. Rowe Price vs. Vanguard

Choosing a financial company to manage your investments can be intimidating, but this blog post will help you compare the pros and cons of T. Rowe Price vs Vanguard to make the best decision for your investment goals.

Read More

18516